Brea Bankruptcy Attorney

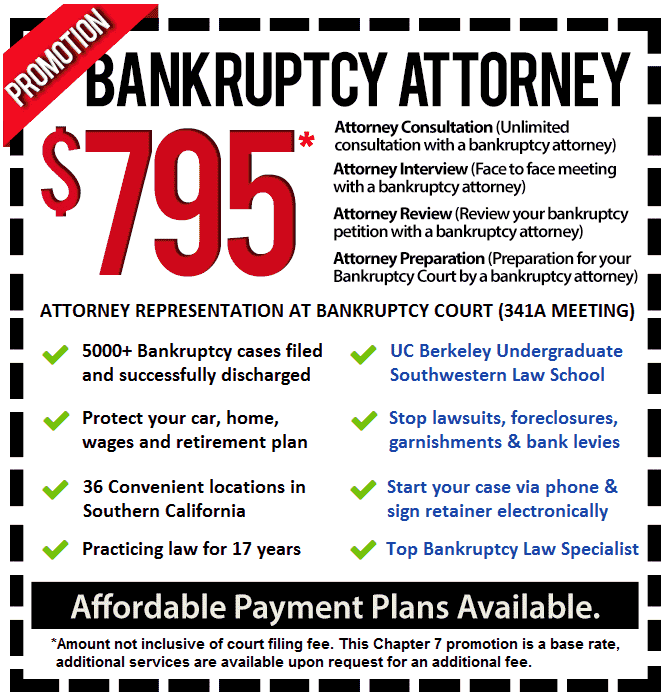

Bankruptcy is an option for individuals and businesses who are experiencing grave debt problems that threaten their assets and incapacitates them in their ability to conduct normal personal or business affairs. Brea consumers and business owners in distress can call a Brea bankruptcy attorney at (888) 754-9877 to discuss their financial situation.

You do have a choice in the type of bankruptcy to file in most cases though consumers have to meet certain income and debt limits that a Brea bankruptcy attorney can verify. Individuals and businesses can elect to file Chapter 7, a liquidation proceeding where certain debts are wiped out. Businesses with the help of a Brea bankruptcy attorney can dissolve their operations and sell off assets to creditors

Individuals can opt to file Chapter 13 where creditors are repaid over 3 or 5 years and can retain their assets. Businesses can seek to reorganize and emerge solvent under Chapter 11, a more complex repayment proceeding that involves many formalities and more court involvement.

You will need the advice of a Brea bankruptcy attorney regarding the type of bankruptcy that is suited to your financial circumstances. Brea bankruptcy attorneys handle all 3 of the main types of bankruptcy.

Chapter 7 Bankruptcy

Consumers who meet income criteria may elect to file Chapter 7 after consulting with a Chapter 7 Bankruptcy Lawyer. Personal assets are also evaluated by a Chapter 7 Bankruptcy Lawyer to be sure that most if not all can be exempt.

Chapter 7 can erase debt like credit card charges, department store bills, medical bills, personal loans, promissory notes, repossession deficiencies, some unpaid taxes, payday loans and others. A Chapter 7 Bankruptcy Lawyer can point out what debts are not dischargeable such as most student loans and arrearages in court ordered support payments.

Brea consumers do have certain obligations before and after filing that a Chapter 7 Bankruptcy Lawyer can ensure are followed. A typical proceeding takes about 4 months from filing to discharge.

Chapter 13 Bankruptcy

Consumers and Brea sole proprietors can file under Chapter 13 if assets are in danger of being seized or surrendered or the individual is not eligible to file Chapter 7. This is a decision made in consultation with a Chapter 13 Bankruptcy Attorney. If you elect to file, a Chapter 13 Bankruptcy Attorney will file a repayment plan over a 3 or 5 year period. Secured creditors and those with priority are paid in full. With the assistance of a Chapter 13 Bankruptcy Attorney, Brea homeowners can avoid foreclosure or auto repossession with the arrearages included in the plan.

Brea debtors make a single monthly payment to the trustee over the life of the plan. Secured property can be devalued by a Chapter 13 Bankruptcy Attorney that is included in the plan. Most if not all unsecured debt is generally discharged when the plan concludes.

Chapter 11 Bankruptcy

A struggling business may contemplate filing for protection and reorganization under Chapter 11 if a feasible plan can be devised by a Chapter 11 Bankruptcy Lawyer. Under this filing, a Chapter 11 Bankruptcy Lawyer submits a disclosure statement to creditors regarding detailed information about the company. The Brea bankruptcy lawyer will also submit the reorganization plan for the creditors to confirm or not. Creditors can also file competing plans.

Should the plan be confirmed, the company is permitted to conduct its normal business. Its reorganization though will generally entail major business decisions such as downsizing, retaining business specialists and breaking current contracts and agreements that must be approved by the bankruptcy court. The Brea bankruptcy lawyer files progress reports for the court and ensures compliance with other rules.

Individuals with large debt who cannot file under Chapter 7 or 13 may elect Chapter 11 also after consultation with a Brea bankruptcy lawyer.

Call a Brea bankruptcy lawyer at (888) 754-9877 for more information about how bankruptcy could be the solution to your debt situation.